How Upstream, part of MERJ Exchange, leverages Ethereum blockchain technology for stock trading

By Vanessa Malone

The cryptocurrency and greater blockchain markets are experiencing an impressive surge. Data from CoinMarketCap shows Bitcoin approaching the $90,000 mark, while Ethereum has climbed to $2,300,¹ adding ~35% to its market cap in the last week.2 This positive growth points to wider acceptance and adoption for the underlying technology.

What is Ethereum and how does Upstream leverage this technology to usher in the future of trading?

Note: Upstream is not a cryptocurrency market. Upstream is a stock trading market powered by blockchain technology.

What is Ethereum?

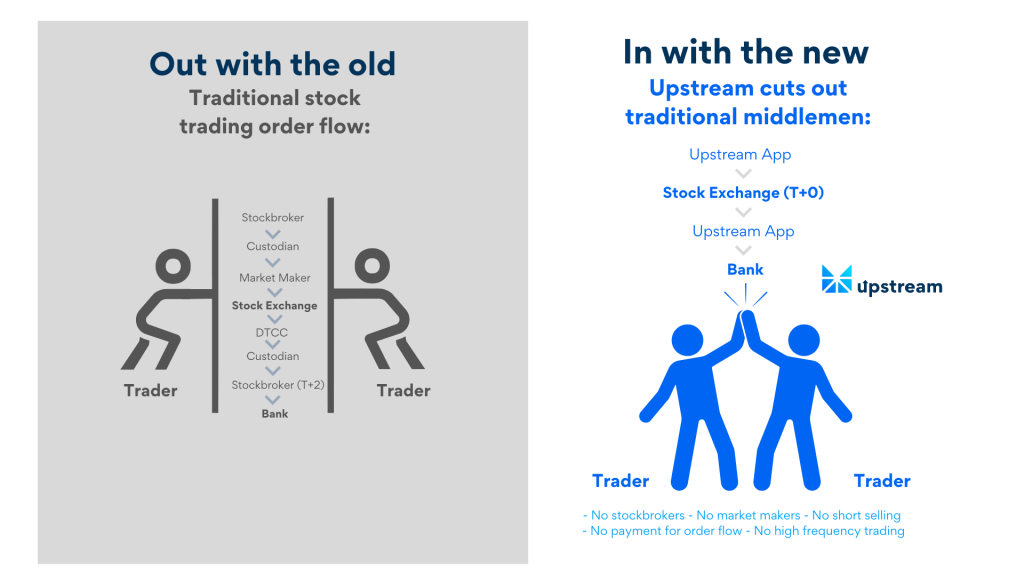

While Bitcoin is more of an alternative to physical currency and fiat, Ethereum can be thought of as a decentralized internet from which applications are built on. These use cases span across all areas of traditional finance and aim to enhance or replace outdated processes with more transparency, efficiency, and accessibility. These apps, commonly known as decentralized applications or dapps, leverage smart contracts to replace typical middlemen that help facilitate transactions. Smart contracts are contracts written in code that are automatically executed when certain conditions are met. It enables peer-to-peer movement.

Ether (ETH) is the native currency used on Ethereum, which powers these transactions. Since the launch of Ethereum, ETH continues to be the second-largest cryptocurrency by market value.2 Ethereum as a programmable blockchain is a game-changer, with thousands of dapps across lending, DeFi, social, and trading.

How does Upstream leverage Ethereum?

Upstream, part of MERJ Exchange, aims to be a global trading hub for investors around the world to buy and sell traditional stocks and other equities right from their phones.

At first glance, Upstream provides global investors with a secure, real-time, and user-friendly stock trading platform. But beneath the surface, Upstream leverages Ethereum blockchain technology to set a new standard for the future of trading.

Upstream is powered by Horizon’s ERC-20 smart contract securities ecosystem running on an Ethereum layer-2 optimistic-rollup. Doing this enables Upstream to feature best bids and offers openly displayed on a public orderbook, with trades executed on-chain. This is a big deal. Most trading apps only offer windows into an exchange. Upstream offers traders direct access to the exchange using an Ethereum layer-2 blockchain.

Why layer-2?

A layer-2 solution is built on top of Ethereum Mainnet, layer-1, and works to address scalability and other pain points the original blockchain architecture has by taking transactions off of the Mainnet while maintaining the decentralized security model that layer-1 provides.

Because Upstream’s trading orderbooks aren’t consolidated by brokers and trading is peer-to-peer, there can be hundreds of bids and offers involved in trading a security. The potential high level of price volatility and trade executions would not work efficiently on layer-1.

We also couldn’t achieve the transaction speed we needed on a large-scale layer-1 network with thousands of validators.

For a use case like the technology powering Upstream, a next generation trading app with real time trades and settlements, layer-2 was the perfect home to build on.

Additional blockchain benefits for traders

- Instant trades and settlement. Trade executions are real-time and transparently performed on a best bid/offer basis.

- Expanded trading hours. Trade at your convenience 20 hours a day, 7 days a week with direct access to the exchange from your phone.

- Flexible funding. Download Upstream and fund your account with USDC digital currency, a debit/credit card, PayPal, and USD funding ramps.

- No market manipulation techniques. No short selling, no payment for order flow (PFOF), or other market manipulations enforced by smart-contract technology.

In conclusion

As a pioneer in this space, Upstream leverages blockchain technology to provide a transparent, secure, and efficient trading infrastructure. By removing traditional intermediaries, we aim to empower investors. Investors may download Upstream from their preferred app store at https://upstream.exchange/. Issuers interested in reaching global investors can get started at https://upstream.exchange/getlisted.

Sources

1 CoinMarketCap | 2 CoinMarketCap

Disclaimers:

U.S. persons may not deposit, buy, or sell securities on Upstream. Anyone may buy and sell Collectibles on Upstream.

This communication shall not constitute an offer to sell securities or the solicitation of an offer to buy securities in any jurisdiction where such offer or solicitation is not permitted. Collectibles have no royalties, equity ownership, or dividends. Collectibles are for utility, collection, redemption, or display purposes only. Anyone may buy and sell Collectibles on Upstream. All orders for sale are non-solicited by Upstream and a user’s decision to trade securities must be based on their own investment judgment.

Upstream is a MERJ Exchange market. MERJ Exchange is a licensed Securities Exchange, an affiliate of the World Federation of Exchanges, a National Numbering Agency, and a member of ANNA. MERJ is regulated in the Seychelles by the Financial Services Authority, https://fsaseychelles.sc/, an associate member of the International Association of Securities Commissions (IOSCO). MERJ supports global issuers of traditional and digital securities through the entire asset life cycle from issuance to trading, clearing, settlement, and registry. It operates a fair and transparent marketplace in line with international best practices and principles of operations of financial markets. Upstream does not endorse or recommend any public or private securities bought or sold on its app. Upstream does not offer investment advice or recommendations of any kind. All services offered by Upstream are intended for self-directed clients who make their own investment decisions without aid or assistance from Upstream. All customers are subject to the rules and regulations of their jurisdiction. By accessing the site or app, you agree to be bound by its terms of use and privacy policy. Company and security listings on Upstream are only suitable for investors who are familiar with and willing to accept the high risk associated with speculative investments, often in early and development-stage companies. U.S. persons may not deposit, buy, or sell securities on Upstream. There can be no assurance the valuation of any particular company’s securities is accurate or in agreement with the market or industry comparative valuations. Investors must be able to afford market volatility and afford the loss of their investment. Companies listed on Upstream are subject to significant ongoing corporate obligations including, but not limited to disclosure, filings, and notification requirements, as well as compliance with applicable quantitative and qualitative listing standards.

Collectible products are akin to a digital sticker of an underlying artwork and should not be considered a financial investment; a security token, an e-money token, or a form of digital currency. Collectibles should not, therefore, be purchased by anyone seeking financial gain or with an expectation to profit from the purchase, ownership in the entity, dividends or distributions, sale or resale of a Collectible. By buying a Collectible, you agree that you are not doing so for investment purposes or for the purposes of obtaining a security or an appreciating asset. You understand that the benefit you receive for buying a Collectible is limited to supporting athletes, celebrities and other brands. You also acknowledge that ownership of a Collectible does not carry with it any rights, express or implied, including (without limitation) copyright, trademarks or other intellectual property or proprietary rights in and to the underlying artwork. The copyright to the digital artwork remains with the copyright holder.

Forward-Looking Statements

This communication contains “forward-looking statements.” Such statements may

be preceded by the words “intends,” “may,” “will,” “plans,” “expects,”

“anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,”

“hopes,” “potential,” or similar words. Forward-looking statements are not

guarantees of future performance, are based on certain assumptions, and are

subject to various known and unknown risks and uncertainties, many of which are

beyond the Company’s control, and cannot be predicted or quantified, and,

consequently, actual results may differ materially from those expressed or

implied by such forward-looking statements. Such risks and uncertainties

include, without limitation, risks and uncertainties associated with (i)

difficulties in obtaining financing on commercially reasonable terms; (ii)

changes in the size and nature of our competition; (iii) loss of one or more

key executives or brand ambassadors; and (iv) changes in legal or regulatory

requirements in the markets in which we operate. The Company assumes no

obligation to publicly update or revise its forward-looking statements as a

result of new information, future events or otherwise.