Category Archives: Uncategorized

Upstream KYC Identity Verification Just Got Even Easier

We’ve updated our KYC process to make it smoother than ever, get verified and start trading on Upstream Upstream’s Know Your Customer (KYC) process just got an upgrade! Our development team has given the identity verification journey a fresh new look, making it even more intuitive and seamless. While the process remains quick and secure, the […]Continue Reading

Posted inUncategorized

Tokenization in Action: Real-World Assets

What companies are transforming real-world assets today? In our last two blogs, we explored tokenization in action with stablecoins and securities trading. Another real-world example of tokenization happening today is the digitization of real-world assets (RWAs). RWAs refer to tangible assets like real estate, fine art, and commodities like gold. Leveraging blockchain technology, these assets can […]Continue Reading

Posted inUncategorized

Tokenization in Action: Securities Trading

We believe tokenized securities trading represents the future of global securities trading By Vanessa Malone In our last piece, we explored stablecoins as a leading example of tokenization in action. But stablecoins are just one piece of a much larger transformation. Another rapidly growing application is the digitization of traditional securities. Securities trading, leveraging tokenization […]Continue Reading

Posted inUncategorized

How to open an account on Upstream

Trade stocks from U.S. and international companies on one blockchain-powered stock trading app. Part of MERJ Exchange. By Vanessa Malone Upstream, part of MERJ Exchange, is a next generation trading app revolutionizing access to global markets. The platform provides investors with direct, real-time access to buy and sell traditional equities like stocks, real-world assets, and […]Continue Reading

Posted inUncategorized

Introducing USDT Deposits on Upstream: A New Era of Convenience

Investors can now fund their Upstream accounts with Tether (USDT) By Andrew Le Gear, Chief Technology Officer At Upstream, a MERJ Exchange market, we are constantly innovating to provide our users with the best possible experience. Today, we are excited to announce a new feature in our Upstream software product: USDT Deposits. This feature is designed […]Continue Reading

Posted inUncategorized

New Upstream Dual Listing: Quantum BioPharma

Quantum BioPharma, Ltd. is now available on Upstream under the ticker symbol ‘QNTM’. The dual listing on Upstream is designed to provide Quantum BioPharma the opportunity to access a global investor base outside the U.S., unlocking liquidity and enhancing price discovery while globalizing the opportunity to invest in the company. Traders on Upstream’s smart contract-powered platform will […]Continue Reading

Posted inUncategorized

What’s the bridge that will bring real-world asset trading to the masses?

Bridging the gap between traditional and digital trading with real-world assets (RWAs) Real-world assets (RWAs) have long been discussed as a game-changing force in the investment world, offering greater accessibility through fractional ownership, liquidity, and transparency with tokenization. While the conversation around tokenizing RWAs isn’t new, the current wave of excitement surrounding crypto ETFs, Bitcoin reaching […]Continue Reading

Posted inUncategorized

How Does Tokenizing Assets Make Them Easier to Trade?

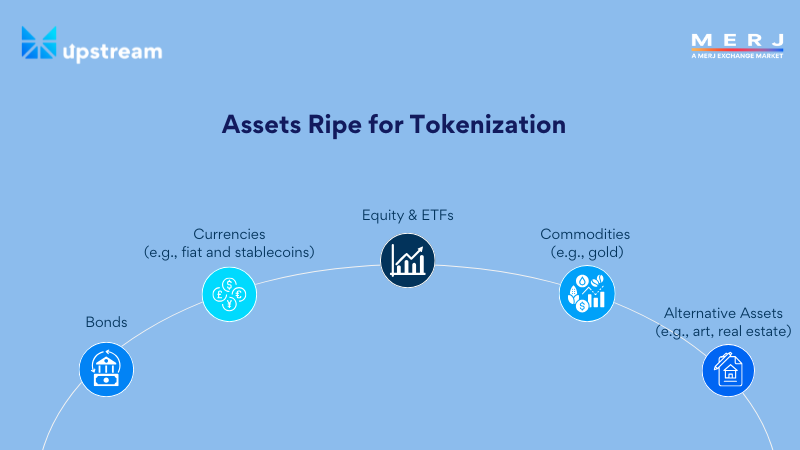

Asset tokenization and the key benefits it offers investors globally By Vanessa Malone The market for tokenized assets is expected to reach trillions by 2030, fueled by the growing adoption of leveraging blockchain technology to make digital representations of a broad range of financial and real-world assets (RWAs).¹ These assets span categories like equities (e.g., […]Continue Reading

Posted inUncategorized

How Upstream’s Signing Key Empowers Investors with Secure Asset Management on Your Phone

What is a Signing Key and how does it empower investors? By Vanessa Malone In today’s digital economy, accessibility and security are paramount for investors managing their portfolios. Upstream, a MERJ Exchange market and stock trading app, leverages Signing Key technology to give investors complete control over their assets right from the palm of their […]Continue Reading

Posted inBlog, DeFi, Uncategorized

New Upstream Dual Listing: Global Compliance Applications Corporation

Global Compliance Applications Corporation is now available on Upstream under the ticker symbol ‘GCAC’. The dual listing on Upstream is designed to provide GCAC the opportunity to access a global investor base outside the U.S., unlocking liquidity and enhancing price discovery while globalizing the opportunity to invest in the company. Traders on Upstream’s smart contract-powered platform will […]Continue Reading

Posted inUncategorized