Here’s why we believe Upstream is the future of stock trading

By Vanessa Malone

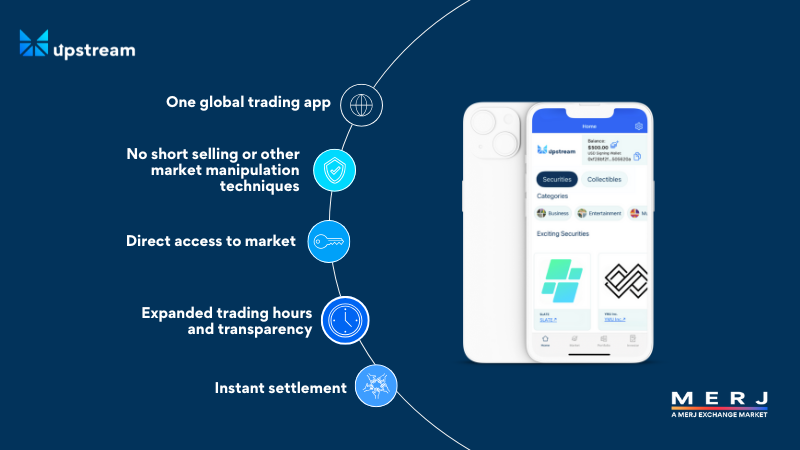

When it comes to modernizing stock trading, Upstream is differentiating itself from traditional platforms by focusing on a next-level trading experience that empowers today’s investors. While conventional exchanges often rely on brokers, limited funding methods, and traditional trading hours, Upstream offers direct access to a peer-to-peer market with real-time trading, flexible funding methods including PayPal and USDC, and 20/7 trading availability.

Leveraging blockchain technology with investor-focused features, Upstream aims to usher in the next evolution of trading. Here are some of the side-by-side benefits Upstream offers compared to other traditional stock trading platforms.

Trading on Upstream

- Experience direct access to stock exchange*. Most platforms offer windows into exchanges. Upstream is part of MERJ Exchange, offering direct access to the market through the trading app.

- Fund with a credit/debit card, PayPal, or USDC digital currency. This flexibility ensures quick and efficient account funding based on investor preference.

- No short selling, no payment for order flow or market maker lending. Upstream fosters a transparent, fair trading environment free from practices that can create conflicts of interest or market manipulation techniques.

- Non-custodial account for cash and securities. With a non-custodial account, you maintain full control of your assets directly on your device, rather than relying on a third-party exchange or platform. To enhance security, Upstream requires biometric verification for every transaction whether you’re buying, selling, bidding, auctioning, or withdrawing funds. This ensures your assets remain safe and accessible only to you.

- 20/7 trading. Smart contracts don’t need sleep, enabling expanded trading hours on Upstream. This means you can trade anytime, anywhere, depending on your schedule or time zone.

- Peer-to-peer execution and instant settlement. Enjoy real-time trading with all bids and offers shown to users, free of charge. Trade executions are transparently performed and instantly settled on a best bid/offer basis.

- Capital formation (IPO) support and fractional ownership. As a fully regulated market, Upstream is a peer to the OTC markets (i.e. Upstream is not a mini-market like an ATS or MTF). This means qualified issuers may cross-list Upstream/ MERJ securities in other global markets. Upstream also can support tokenization and fractionalization of stocks and real-world assets for greater accessibility.

- Digital coupons and collectibles for shareholder engagement. Upstream offers issuers unique shareholder engagement tools including coupons that can be redeemed for product or services, which aims to turn shareholders into customers and customers into shareholders.

Trading on other Platforms

- Investors may require a broker to access the market.

- Traditional payment methods may not include modern account funding methods.

- Short selling and payment for order flow practices may be available on some trading platforms.

- Securities may be held on the platform on behalf of the investor.

- Trading hours may be limited to business hours.

- Settlement may take several days. Currently many exchanges operate with T+1 settlement.

- Limited support for raising capital or no direct fractional ownership.

- Limited integrated features for shareholder engagement.

Upstream is redefining what it means to trade in today’s capital markets. Unlike traditional platforms that rely on legacy systems and practices, Upstream offers a modern, blockchain-powered alternative designed to enhance transparency, accessibility, and fairness.

Stay connected to hear about upcoming opportunities for traders on Upstream. Issuers interested in listing on Upstream can get started here. Investors (non-U.S.) can download Upstream on iOS or Android.

Note: U.S. persons may not deposit, buy, or sell securities on Upstream.

Disclaimers:

* https://merj.exchange/trading/marketplaces/upstream

U.S. persons may not deposit, buy, or sell securities on Upstream. Anyone may buy and sell Collectibles on Upstream.

This communication shall not constitute an offer to sell securities or the solicitation of an offer to buy securities in any jurisdiction where such offer or solicitation is not permitted. Collectibles have no royalties, equity ownership, or dividends. Collectibles are for utility, collection, redemption, or display purposes only. Anyone may buy and sell Collectibles on Upstream. All orders for sale are non-solicited by Upstream and a user’s decision to trade securities must be based on their own investment judgment.

Upstream is a MERJ Exchange market. MERJ Exchange is a licensed Securities Exchange, an affiliate of the World Federation of Exchanges, a National Numbering Agency, and a member of ANNA. MERJ is regulated in the Seychelles by the Financial Services Authority, https://fsaseychelles.sc/, an associate member of the International Association of Securities Commissions (IOSCO). MERJ supports global issuers of traditional and digital securities through the entire asset life cycle from issuance to trading, clearing, settlement, and registry. It operates a fair and transparent marketplace in line with international best practices and principles of operations of financial markets. Upstream does not endorse or recommend any public or private securities bought or sold on its app. Upstream does not offer investment advice or recommendations of any kind. All services offered by Upstream are intended for self-directed clients who make their own investment decisions without aid or assistance from Upstream. All customers are subject to the rules and regulations of their jurisdiction. By accessing the site or app, you agree to be bound by its terms of use and privacy policy. Company and security listings on Upstream are only suitable for investors who are familiar with and willing to accept the high risk associated with speculative investments, often in early and development-stage companies. U.S. persons may not deposit, buy, or sell securities on Upstream. There can be no assurance the valuation of any particular company’s securities is accurate or in agreement with the market or industry comparative valuations. Investors must be able to afford market volatility and afford the loss of their investment. Companies listed on Upstream are subject to significant ongoing corporate obligations including, but not limited to disclosure, filings, and notification requirements, as well as compliance with applicable quantitative and qualitative listing standards.

Collectible products are akin to a digital sticker of an underlying artwork and should not be considered a financial investment; a security token, an e-money token, or a form of digital currency. Collectibles should not, therefore, be purchased by anyone seeking financial gain or with an expectation to profit from the purchase, ownership in the entity, dividends or distributions, sale or resale of a Collectible. By buying a Collectible, you agree that you are not doing so for investment purposes or for the purposes of obtaining a security or an appreciating asset. You understand that the benefit you receive for buying a Collectible is limited to supporting athletes, celebrities and other brands. You also acknowledge that ownership of a Collectible does not carry with it any rights, express or implied, including (without limitation) copyright, trademarks or other intellectual property or proprietary rights in and to the underlying artwork. The copyright to the digital artwork remains with the copyright holder.

Forward-Looking Statements

This communication contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential,” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which are beyond the Company’s control, and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, risks and uncertainties associated with (i) difficulties in obtaining financing on commercially reasonable terms; (ii) changes in the size and nature of our competition; (iii) loss of one or more key executives or brand ambassadors; and (iv) changes in legal or regulatory requirements in the markets in which we operate. The Company assumes no obligation to publicly update or revise its forward-looking statements as a result of new information, future events or otherwise.