Author Archives: Vanessa Malone

Upstream Enables Custodial Accounts for Minors to Safely Enter NFT Market

Custodial Accounts allow minors to safely participate in NFTs & IPOs By Anastasia Samaras Upstream is proud to announce the latest release which features ‘Custodial Accounts,’ enabling children and teens under 18 to safely participate in NFT and IPO offerings on our exchange. A parent or guardian can now generate a KYC identity verification code […]Continue Reading

Posted inBlog, NFTsLeave a comment on Upstream Enables Custodial Accounts for Minors to Safely Enter NFT Market

NBA Hall of Famer Dominique Wilkins joins Upstream as Strategic Brand Ambassador

As a strategic brand ambassador, Dominique Wilkins will advise athletes and public figures on how to integrate NFTs into their personal brand-building initiatives using Upstream By Fernanda De La Torre This week we announced that NBA Hall of Famer and Hawks’ Vice President of Basketball Dominique Wilkins joined Upstream as a strategic brand ambassador. We’re […]Continue Reading

Posted inBlogLeave a comment on NBA Hall of Famer Dominique Wilkins joins Upstream as Strategic Brand Ambassador

Upstream Introduces Geofenced NFT Integration

By Anastasia Samaras Upstream is at the cutting edge of unique NFT integrations! Rather than focus on only high-ticket NFTs that may exclude the masses, we support NFTs that usher in the next generation of engagement and Web 3.0. We’re working with clients across sports, media, and entertainment to offer millions of free, low-cost, and […]Continue Reading

Posted inBlog, NFTs, Upstream UpdatesLeave a comment on Upstream Introduces Geofenced NFT Integration

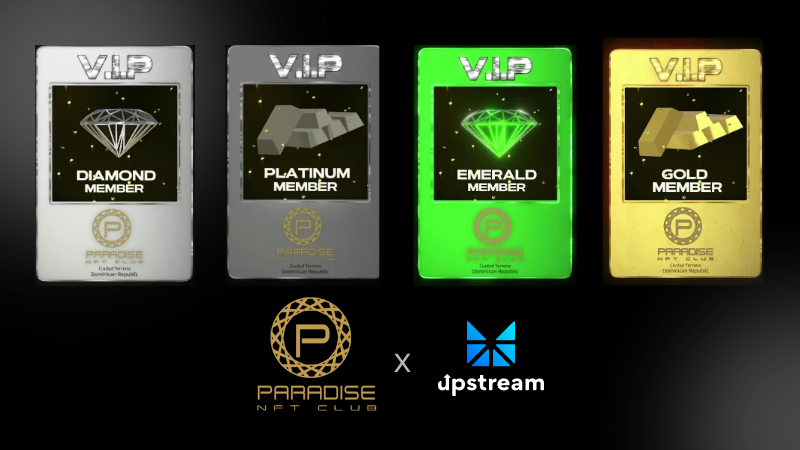

Upstream Powering BPN Capital’s $65 Million Paradise NFT Club Sale

Upstream welcomes a new NFT collection to the exchange By Fernanda De La Torre This week we announced that we’re powering Paradise NFT Club’s $65 million-dollar NFT collection, which is now available for purchase on Upstream. The Time-share Membership NFTs, created by BPN Capital Group, grant owners access to 150 luxury Villas in the Dominican […]Continue Reading

Posted inBlog, NFTsLeave a comment on Upstream Powering BPN Capital’s $65 Million Paradise NFT Club Sale

Upstream Introduces New Share-to-Receive NFT Integration

Tweet about a project, and fans instantly receive a free NFT in their Upstream portfolio as a reward for their promotion. By Anastasia Samaras Upstream is at the cutting edge of unique NFT integrations! Rather than focus on only high-ticket NFTs that may exclude the masses, we support NFTs that usher in the next generation […]Continue Reading

Posted inBlog, NFTsLeave a comment on Upstream Introduces New Share-to-Receive NFT Integration

Upstream adds NFL Hall of Famer Edgerrin James as an athlete brand ambassador

Strategic brand ambassador Edgerrin James will be advising college and professional athletes on how to integrate NFTs into their personal brand-building strategies using Upstream By Fernanda De La Torre This week we announced that Colts Hall of Famer Edgerrin James joined Upstream as a strategic brand ambassador. We’re very excited to have Edgerrin James on […]Continue Reading

Posted inBlog, NFTsLeave a comment on Upstream adds NFL Hall of Famer Edgerrin James as an athlete brand ambassador

The Ultimate Guide to Emerging NFT Categories

By Anastasia Samaras According to DappRadar, NFT sales exceeded $25 billion in 2021.¹ Given a large amount of revenue created in such a short period of time, some may be asking how NFT creators are putting these new revenue sources to use. There is no limit to what can be counted as an NFT, and […]Continue Reading

Posted inBlog, NFTsLeave a comment on The Ultimate Guide to Emerging NFT Categories

How NFTs can empower college athletes and accelerate their athletic career

With the NCAA’s new rules surrounding NIL, college athletes can now leverage their brand and release NFT projects that can help fund and accelerate their career By Fernanda De La Torre Over the past year, the NFT market has continued to grow and evolve drastically. From PFP NFTs, to membership NFTs, to NFTs representing home […]Continue Reading

Posted inBlog, NFTsLeave a comment on How NFTs can empower college athletes and accelerate their athletic career

NFTs Bridging the Gap between Physical and Digital Merchandise

How NFTs can be connected to physical merchandise By Anastasia Samaras When you think of an NFT (Non-Fungible Token), first thoughts typically go to traditional art pieces or high-profile digital art collections like the Bored Ape Yacht Club or CryptoPunks. We believe that was just phase one of the NFT market, one that will be joined by […]Continue Reading

Posted inBlog, NFTsLeave a comment on NFTs Bridging the Gap between Physical and Digital Merchandise

NFTs open new doors in the entertainment industry

NFTs bring the entertainment industry innovative ways to fund projects and boost fan engagement By Fernanda De La Torre The entertainment industry as we know it is changing. These changes are being accelerated by the pandemic, new technology, and the rise of new mediums fans are consuming material from. Due to the closure of cinemas […]Continue Reading

Posted inBlog, NFTsLeave a comment on NFTs open new doors in the entertainment industry