Tag Archives: trading

How to transfer shares to Upstream

How do I transfer my shares to Upstream from my brokerage or transfer agent? Upstream, part of MERJ Exchange, can accept the shares that you hold in your current brokerage account, shares that are held at the transfer agent in book entry, or your physical stock certificate. Here’s how to deposit your shares, step by step. […]Continue Reading

Posted inBlog, Technology

What can you trade on Upstream, a MERJ Exchange market?

Trade equities from U.S. and international companies on one blockchain-powered stock trading app By Vanessa Malone Upstream is a next generation stock trading app part of MERJ Exchange. Powered by blockchain technology, Upstream gives investors (excluding U.S. persons) direct exchange access to equities from U.S. and international companies. U.S. persons may not deposit, buy, or sell […]Continue Reading

Posted inUncategorized

Why Upstream is the Next-Gen Market for Maximizing Liquidity and Investor Access

Increase liquidity potential & reach new retail investors on Upstream, a MERJ Exchange market By Vanessa Malone Do your international shareholders have difficulty depositing shares for secondary trading? Do overseas investors struggle to buy your stock on your current exchange? Upstream, part of MERJ Exchange, welcomes issuers listed on U.S. or international stock exchanges to dual […]Continue Reading

Posted inDual Listing

Blockchain Never Sleeps: What If Stock Markets Were Open 24/7 During Market Sell-Offs?

What advantages could blockchain powered stock trading have during times of market sell-offs? By Vanessa Malone This past Monday morning, the Dow Jones Industrial Average fell more than 1,000 points.¹ The Nikkei 225, an index of leading stocks in Tokyo, closed down 5.8% Friday, and then 12.4% on Monday.² With traditional stock trading hours, an […]Continue Reading

Posted inNews commentary

Join the Next Generation of Trading: Upstream Welcomes Three New Issuers to the MERJ Exchange Market

Smart-contract powered market empowers issuers and investors By Vanessa Malone Upstream, a next generation market part of MERJ Exchange, is proud to announce that LeapCharger (OTC: LCCN) (Upstream: LCCN) and Blackwell 3D Construction Corp. (OTC: BDCC) (Upstream: BDCC) have successfully dual listed this week. Additionally, Foremost Lithium Resource & Technology Ltd. (NASDAQ: FMST) (CSE: FAT) […]Continue Reading

Posted inUncategorized

Innovating Stock Markets: The Rise of New Exchanges

How new markets like TXSE and Upstream/MERJ are Pioneering Efficient and Accessible Trading By Fernanda De La Torre When you think of capital markets, your mind typically goes to the stock markets like NYSE, Nasdaq, London Stock Exchange, and Tokyo Stock Exchange. Recently, there has been a push towards more efficient, transparent markets that offer […]Continue Reading

Posted inUncategorized

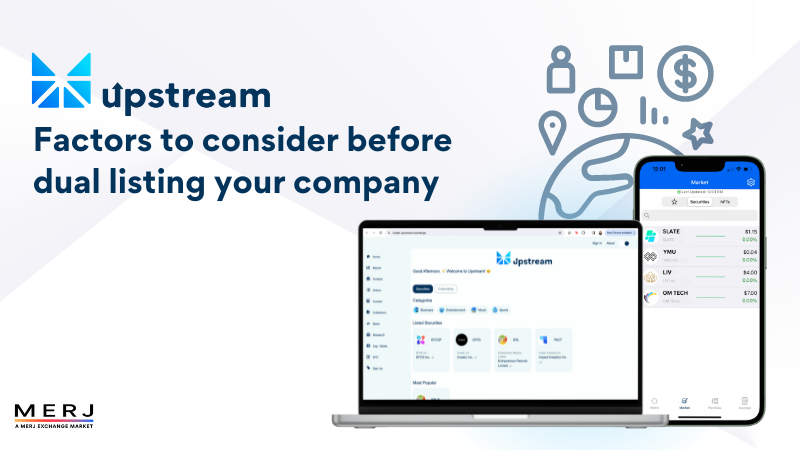

Factors to consider before dual listing your company

How does Upstream, a MERJ Exchange market, address common hurdles issuers face when dual listing By Fernanda De La Torre and Vanessa Malone In recent discussions, we’ve delved into the strategic benefits that dual listing offers to companies aiming to appeal to international investors. This week, we’re shifting our focus to the essential factors that […]Continue Reading

Posted inUncategorized

Introducing Upstream’s dual listing issuer: PetVivo Holdings, Inc.

Broadening investor access on Upstream’s Global Securities Trading App By Fernanda De La Torre This week, we announced PetVivo Holdings, Inc. (NASDAQ: PETV & PETVW) (“PetVivo”) live dual listing on Upstream under the ticker symbol ‘PETV’. The dual listing on Upstream works to provide digital-first investors around the world with streamlined access to PetVivo shares […]Continue Reading

Posted inUncategorized

Upstream gives global exposure opportunity to dual listing issuers

Unlock enhanced liquidity potential and a diverse investor base with Upstream By Fernanda De La Torre In the dynamic world of trading, Upstream, a MERJ Exchange market, aims to be a pivotal trading venue that not only expands reach to new international investors but also leverages our media community to increase visibility around an issuer’s […]Continue Reading

Posted inUncategorized

Upstream Announces Exchange Dual Listing Program for 2024

Upstream working to create economic development for foreign exchanges and their issuers with streamlined dual listings on Upstream’s global trading app By Fernanda De La Torre As it stands today, it is difficult for international investors to buy U.S. and Canadian listed securities. Retail investors outside the U.S. and Canada don’t typically have streamlined access to […]Continue Reading

Posted inUncategorized