What is payment for order flow and how does Upstream’s smart-contract-powered market avoid it?

By Anastasia Samaras

In the world of online trading, there’s often more happening than meets the eye surrounding opportunities such as commission-free trading, which has ignited some debate within financial circles for its potential implications on market fairness and transparency. At the core of this is payment for order flow.

What is payment for order flow?

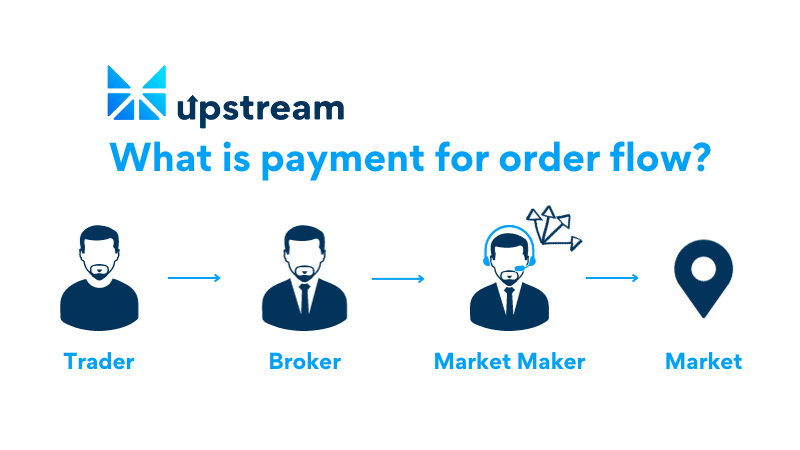

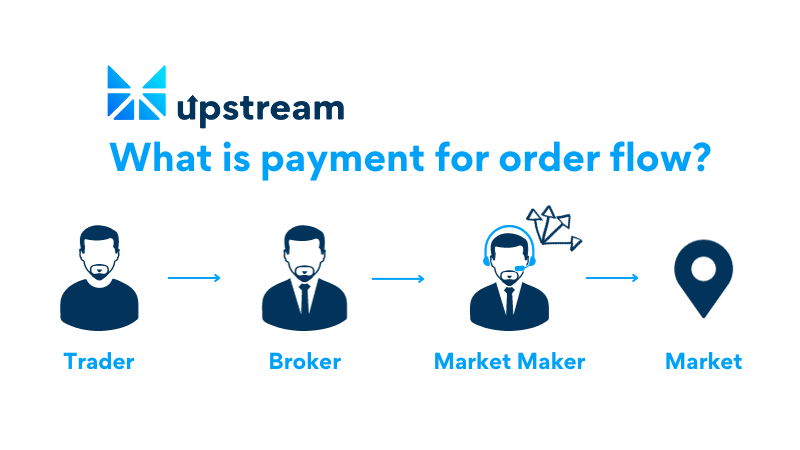

Payment for order flow (PFOF) is a form of compensation, usually in terms of fractions of a penny per share, that a brokerage firm receives for directing orders for trade execution to a particular market maker or exchange.¹

Individuals who trade through online brokerage accounts may assume they have a direct connection to the securities markets, wherein you submit your order to a brokerage, then the brokerage delivers your shares. It’s not that black and white. When you submit a trade order from your desktop or through most smartphone trading apps, your order is sent to your broker. In a payment for order flow model, the brokerage then routes that order to a third party known as a market maker, not directly to a public exchange. These third parties then decide on which public exchange to send the order to for execution.

Who are market makers and why do they pay for order flow?

In the financial marketplace, market makers act as market intermediaries, and they decide which market to send orders to for execution. Market makers set the stage with their two-sided quotes. They buy and sell securities at slightly different prices (the bid and ask), capturing the space between their profit — and thespread.²

Market makers need a steady stream of buy and sell orders to fulfill their role as liquidity providers. That’s where payment for order flow (PFOF) comes in. Essentially, market makers pay brokers a small fee for directing investor orders their way. This influx of trades increases their order book depth, potentially allowing them to widen the bid-ask spread — which translates to higher profits.

However, navigating the market is far from a predictable stroll. Price fluctuations pose a constant threat, meaning a poorly timed purchase could leave a market maker holding a depreciating asset. So, it’s a delicate balancing act: managing risk, aiming for wider spreads, and continuously attracting order flow through payment for order flow (PFOF) keeps these financial professionals on their toes.

The murky waters of payment for order flow (PFOF)

While payment for order flow (PFOF) has the potential to reduce costs for investors, as some of the generated revenue can be passed on, regulators like the SEC in the U.S. have raised concerns about the impact payment for order flow may have on quote competition.³ Matching other exchanges’ prices, as seen in options markets, can discourage displaying competitively priced quotes and ultimately widen spreads, increasing execution costs for everyone.

Payment for order flow (PFOF) and internalization may also raise troubling questions about conflicts of interest. Brokers have a fiduciary duty to prioritize their clients’ best execution, yet they also stand to gain financially by directing orders to preferred market makers or internalizing trades for themselves. This can lead to hidden costs for investors, who may not be getting the best possible price or execution if brokers prioritize their profits over clients’ interests.

This lack of transparency around payment for order flow (PFOF) payments leaves retail investors in the dark, unable to gauge potential conflicts of interest. Market makers could potentially exploit this obscurity to widen spreads or execute trades at less favorable prices for retail investors, putting them at a disadvantage.

Upstream’s stance on payment for order flow

There is no payment for order flow on Upstream, a MERJ Exchange market. Upstream is committed to building a transparent trading environment — and that means addressing the concerns surrounding payment for order flow. Here’s how Upstream breaks the mold:

- No payment for order flow (PFOF): Upstream does not engage in payment for order flow (PFOF) practices. Upstream operates with public, on-chain orderbooks, where all bids and offers are shown to users, free of charge.

- Real-time trading and settlement: All Upstream orders are matched and executed peer-to-peer in real-time, ensuring a level playing field for everyone.

- Preventing market manipulation: Smart-contract technology safeguards against predatory trading practices like short selling, protecting both issuers and investors.

- Direct access to the market: Upstream offers direct access to the market through the trading app. This works to allow users to trade without all of the intermediaries that may eat into investors’ returns.

- Equitable access to data: Upstream doesn’t sell real-time trading data to third parties, APIs, or algorithmic trading services. Every trader has equal access to market information.

Upstream is working to usher in a fairer, more transparent trading future. Visit upstream.exchange.

Sources

1 Investopedia | 2 Investopedia | 3 SEC |

Disclaimers

U.S. persons may not deposit, buy, or sell securities on Upstream.

This communication shall not constitute an offer to sell securities or the solicitation of an offer to buy securities in any jurisdiction where such offer or solicitation is not permitted. NFTs have no royalties, equity ownership, or dividends. NFTs are for utility, collection, redemption, or display purposes only. Anyone may buy and sell NFTs on Upstream. All orders for sale are non-solicited by Upstream and a user’s decision to trade securities must be based on their own investment judgment.

Upstream is a MERJ Exchange market. MERJ Exchange is a licensed Securities Exchange, an affiliate of the World Federation of Exchanges, a National Numbering Agency, and a member of ANNA. MERJ is regulated in the Seychelles by the Financial Services Authority, https://fsaseychelles.sc/, an associate member of the International Association of Securities Commissions (IOSCO). MERJ supports global issuers of traditional and digital securities through the entire asset life cycle from issuance to trading, clearing, settlement, and registry. It operates a fair and transparent marketplace in line with international best practices and principles of operations of financial markets. Upstream does not endorse or recommend any public or private securities bought or sold on its app. Upstream does not offer investment advice or recommendations of any kind. All services offered by Upstream are intended for self-directed clients who make their own investment decisions without aid or assistance from Upstream. All customers are subject to the rules and regulations of their jurisdiction. By accessing the site or app, you agree to be bound by its terms of use and privacy policy. Company and security listings on Upstream are only suitable for investors who are familiar with and willing to accept the high risk associated with speculative investments, often in early and development-stage companies. U.S. persons may not deposit, buy, or sell securities on Upstream. There can be no assurance the valuation of any particular company’s securities is accurate or in agreement with the market or industry comparative valuations. Investors must be able to afford market volatility and afford the loss of their investment. Companies listed on Upstream are subject to significant ongoing corporate obligations including, but not limited to disclosure, filings, and notification requirements, as well as compliance with applicable quantitative and qualitative listing standards.

Forward-Looking Statements

This communication contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential,” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which are beyond the Company’s control, and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, risks and uncertainties associated with (i) difficulties in obtaining financing on commercially reasonable terms; (ii) changes in the size and nature of our competition; (iii) loss of one or more key executives or brand ambassadors; and (iv) changes in legal or regulatory requirements in the markets in which we operate. The Company assumes no obligation to publicly update or revise its forward-looking statements as a result of new information, future events or otherwise.