Bypass broker fees and hidden costs with Upstream

By Anastasia Samaras

Upstream’s vision is to become the premiere global trading app from which global retail investors can access equities from all markets.

Upstream, a MERJ Exchange market, features streamlined onboarding, direct access to the exchange, transparent orderbooks, no market manipulations, and real-time settlements, redefining the future of trading with its smart-contract-powered market.

Upstream aims to not just be a trading platform, but a catalyst for financial empowerment, making markets more secure, fair, and efficient.

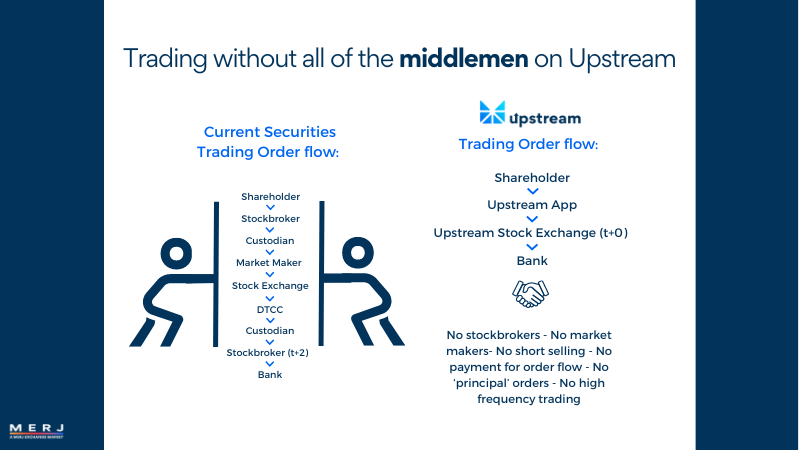

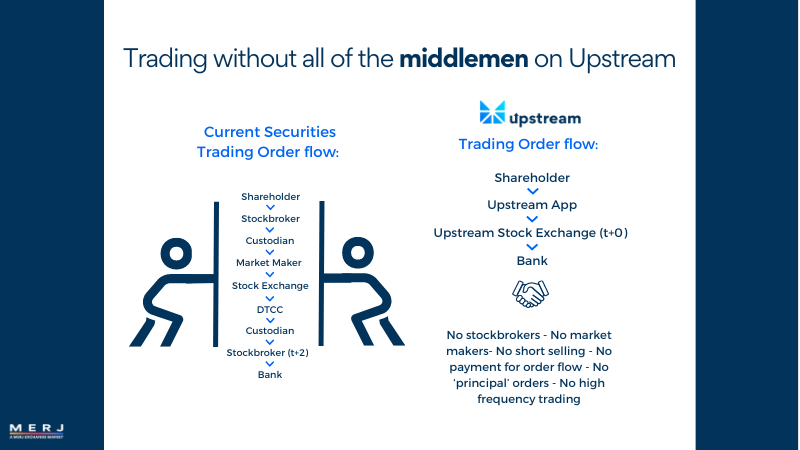

One of the ways it enhances capital markets is by introducing trading without all of the middlemen that may take cuts of investors’ returns.

The reality of trading today: hidden fees and a lack of transparency

The majority of financial services are controlled by central parties and middlemen, which facilitate interactions between parties, typically for commissions or fees.¹ Whether it’s trading, money transfers, asset purchases, etc., you typically must go through multiple parties to execute your trades.

When it comes to retail trading apps, retail trading orders are typically executed by a broker-dealer or designated market makers, “DMMs”. The very popular narrative surrounding 0% trading fees is a fallacy because stockbrokers are paid by market makers for clients’ retail order flows, and market makers simply widen their bids/ask spreads to cover this cost, which impacts the price retail traders see. This can give skewed impressions of how active and liquid a market is, causing prices to fluctuate unpredictably, which can be harmful to retail traders and investors who don’t have the same access to real-time pricing data. Secretive stock lending of shareholders’ shares between broker-dealers can also cause short selling with huge lending fees paid, with mostly stockbrokers and market makers benefiting!

Upstream introduces trading without all the middlemen

Upstream is a revolutionary exchange and trading app giving U.S., Canadian, and other global issuers access to a digital-first investor base who can trade company shares from anywhere using a user-friendly trading app. Note that U.S. persons may not deposit, buy, or sell securities on Upstream.

One of the key differentiators that sets Upstream apart from traditional trading apps is its direct access to the market and transparent orderbooks. This allows users to trade without all of the intermediaries that may eat into investors’ returns, leading to greater trading opportunities and reduced cuts from middlemen.

As a smart-contract powered market, Upstream has a transparent orderbook that is publicly accessible and cannot be altered. Trades are also executed and settled in real-time. This reduces the risk of market manipulation as all market participants have access to the same, up-to-date information about market activity and liquidity.

Our transparent order book leverages Ethereum smart contract technology, which allows for the automation of trading and settlement processes based on pre-defined rules and conditions. Trading apps typically offer windows into exchanges, connecting to stockbrokers who sell retail order flow to market makers for exchange execution. Uniquely, Upstream users have a direct connection to the exchange, removing stockbroker middlemen and market maker “members” to trade peer-to-peer without the need for these intermediaries.

The Upstream advantage

- One global trading app for investors around the world (non-U.S.) to simply download, sign up, and access equities from markets globally.

- Direct access to the market 20 hours a day, 5 days a week.

- No short selling or other market manipulations that may negatively impact issuers and investors, are enforced by smart-contract technology.

- Low one-price trading fee

No:

- Broker fees

- Market maker fees

- Short selling

- Payment for order flow

- Principal orders

- High-frequency trading

Conclusion

Upstream represents a paradigm shift in the world of trading. We are a platform designed for the individual investor, empowering you to take control and trade with confidence.

Download and learn more at https://upstream.exchange/

Sources

Disclaimers

U.S. persons may not deposit, buy, or sell securities on Upstream.

This communication shall not constitute an offer to sell securities or the solicitation of an offer to buy securities in any jurisdiction where such offer or solicitation is not permitted. NFTs have no royalties, equity ownership, or dividends. NFTs are for utility, collection, redemption, or display purposes only. Anyone may buy and sell NFTs on Upstream. All orders for sale are non-solicited by Upstream and a user’s decision to trade securities must be based on their own investment judgment.

Upstream is a MERJ Exchange market. MERJ Exchange is a licensed Securities Exchange, an affiliate of the World Federation of Exchanges, a National Numbering Agency, and a member of ANNA. MERJ is regulated in the Seychelles by the Financial Services Authority, https://fsaseychelles.sc/, an associate member of the International Association of Securities Commissions (IOSCO). MERJ supports global issuers of traditional and digital securities through the entire asset life cycle from issuance to trading, clearing, settlement, and registry. It operates a fair and transparent marketplace in line with international best practices and principles of operations of financial markets. Upstream does not endorse or recommend any public or private securities bought or sold on its app. Upstream does not offer investment advice or recommendations of any kind. All services offered by Upstream are intended for self-directed clients who make their own investment decisions without aid or assistance from Upstream. All customers are subject to the rules and regulations of their jurisdiction. By accessing the site or app, you agree to be bound by its terms of use and privacy policy. Company and security listings on Upstream are only suitable for investors who are familiar with and willing to accept the high risk associated with speculative investments, often in early and development-stage companies. U.S. persons may not deposit, buy, or sell securities on Upstream. There can be no assurance the valuation of any particular company’s securities is accurate or in agreement with the market or industry comparative valuations. Investors must be able to afford market volatility and afford the loss of their investment. Companies listed on Upstream are subject to significant ongoing corporate obligations including, but not limited to disclosure, filings, and notification requirements, as well as compliance with applicable quantitative and qualitative listing standards.

Forward-Looking Statements

This communication contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential,” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which are beyond the Company’s control, and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, risks and uncertainties associated with (i) difficulties in obtaining financing on commercially reasonable terms; (ii) changes in the size and nature of our competition; (iii) loss of one or more key executives or brand ambassadors; and (iv) changes in legal or regulatory requirements in the markets in which we operate. The Company assumes no obligation to publicly update or revise its forward-looking statements as a result of new information, future events or otherwise.