Category Archives: Blog

Horizon CTO Delivers ISE Blockchain Module to the University of Limerick

Dr. Andy Le Gear leads the Immersive Software Engineering (ISE) Blockchain Module at the University of Limerick. Horizon is the technology powering Upstream. By Anastasia Samaras Dr. Andy Le Gear, Horizon’s Chief Technology Officer, wrote and delivered the ISE Blockchain Module. The course is for 2nd Year, Block 8 students on the ISE course at […]Continue Reading

Posted inBlog, Horizon Globex, Press Releases, Upstream Updates

Dual Listing Process on Upstream

A streamlined guide for issuers dual listing on Upstream By Anastasia Samaras Recently, we’ve discussed the benefits of dual listing, including reaching a wider audience, engaging with international investors, and helping to propel your company’s growth. We’ve also addressed key considerations issuers face when embarking on a dual listing strategy, such as navigating regulatory hurdles, pricing, […]Continue Reading

Posted inBlog, Dual Listing

Leveraging Dual Listing to Attract International Investment

By Anastasia Samaras Imagine you’re a growing company with a bright future. You’ve captured the attention of domestic investors, but there’s a whole world of potential investors out there. Diversifying your investor base is a key strategy for public companies but how do you work to accomplish this? Dual listing can be your passport to […]Continue Reading

Posted inBlog, Dual Listing

Turning roadshows into potential dollars- dual listing strategy for issuers

By Anastasia Samaras Roadshows are a cornerstone of any successful listing. They generally take place in major cities around the world and are meant to drum up interest in an upcoming offer. However, issuers often face a gap between generating excitement and securing capital from global retail investors. Why? Traditional processes can come with too […]Continue Reading

Posted inBlog, Dual Listing

Upstream modernizing shareholder engagement

Increasing opportunities for issuers to engage with their shareholders on Upstream’s market By Anastasia Samaras Imagine a world where shareholders become loyal customers and customers become invested shareholders. This innovative vision is at the heart of Upstream’s digital shareholder rewards, added value for companies to boost shareholder engagement, and enhance investor relations (IR) through dual […]Continue Reading

Posted inBlog, Dual Listing, Shareholder

Upstream Up Close: Dual Listing Program

Expanding Opportunities for Issuers & Global Investors By Anastasia Samaras This week, The Upstream team hosted the 12th episode of their “Upstream Up Close” series on Twitter Spaces. This ongoing series features 10–15 minute discussions on the exciting world of digital collectibles, Web3, and trading on the Upstream, MERJ Exchange market, platform. Episode 12 delved […]Continue Reading

Posted inBlog, Uncategorized, Upstream Up Close

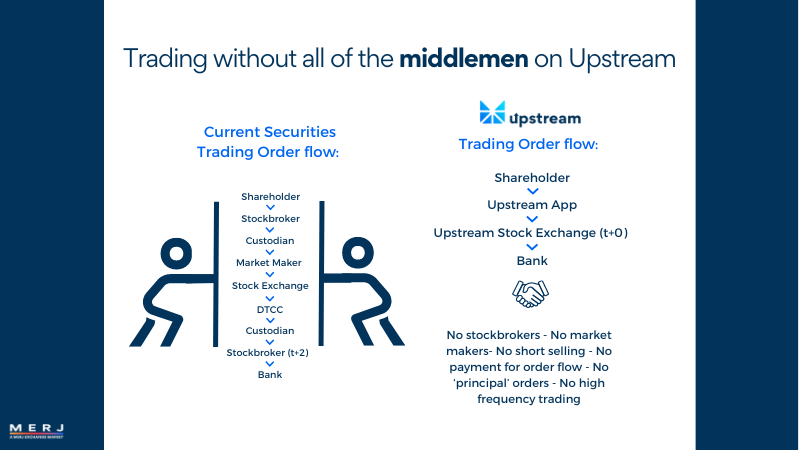

Trading without all of the middlemen on Upstream

Bypass broker fees and hidden costs with Upstream By Anastasia Samaras Upstream’s vision is to become the premiere global trading app from which global retail investors can access equities from all markets. Upstream, a MERJ Exchange market, features streamlined onboarding, direct access to the exchange, transparent orderbooks, no market manipulations, and real-time settlements, redefining the future […]Continue Reading

Posted inBlog, Dual Listing

Upstream surpasses 12,500 users!

Celebrating our growing community eager to trade on Upstream’s global, next-generation trading app By Anastasia Samaras Upstream, a MERJ Exchange market and trading app, has achieved a significant milestone, a thriving community of over 12,500 users and counting all eager to join the future of trading! 12,500 users represent 12,500 unique Upstream digital wallets! The Journey […]Continue Reading

Posted inBlog, Upstream Updates

Upstream Up Close: bitcoin ETFs and the future of blockchain-powered trading

Now accepting applications for Bitcoin ETFs to trade on Upstream’s next-generation retail trading app By Fernanda De La Torre The first Upstream Up Close episode of the year dropped today, this week’s focus, bitcoin ETFs! Following the SEC’s recent approval of the first U.S.-listed bitcoin ETFs on January 10, 2024, aimed at tracking bitcoin’s performance, […]Continue Reading

Posted inUpstream Up Close

Bitcoin ETFs approved by SEC, what could this mean for the future of blockchain-powered trading?

Bitcoin ETFs and the Implications for the future of blockchain-powered applications By Vanessa Malone Last week on January 10th, the U.S. Securities and Exchange Commission granted approval for the first-ever U.S.-listed exchange-traded funds (ETFs) designed to track the performance of bitcoin. The SEC has approved 11 applications,¹ including BlackRock, Ark Investments/21Shares, Bitwise, Fidelity, Grayscale, Invesco and […]Continue Reading

Posted inBlog